send link to app

IRA RMD app for iPhone and iPad

4.8 (

1248 ratings )

Reference

Finance

Developer: Symons Software Solutions LLC

Free

Current version: 1.3, last update: 7 years agoFirst release : 27 Feb 2013

App size: 6.28 Mb

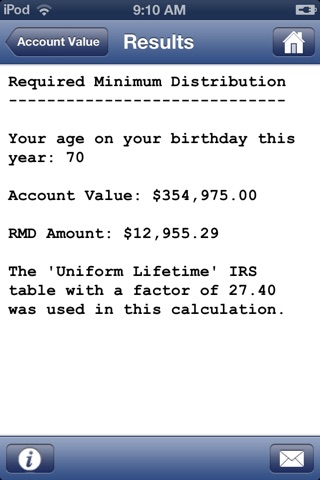

This calculator can be used to determine your Required Minimum Distribution (RMD) from a traditional 401(k) or IRA. In general, you must begin withdrawing money by April 1st of the year following the year that you turn 70½.

In general, your age and account value determine the amount you must withdraw. Note that taxes may be due on distributions from a traditional IRA or 401(k).

Do not include balances from a Roth IRA or Roth 401(k) when using this calculator. This calculator is not designed to work for beneficiary (inherited) IRAs. That capability may be added in a forthcoming update.